Is the automotive LiDAR market dominated by China?

The LiDAR automotive sector will reach US$2 billion in 2027, thanks to a strong push by Chinese players keen to incorporate novel LiDAR technology.

Outline

- The automotive and industrial LiDAR market is estimated to reach $6.3 billion in 2027, with a 22% CAGR between 2022 and 2027.

- With a $38 million market in 2021, the automobile application is the key driver of this increase.

- The conventional topographical and manufacturing industries are the primary participants. RoboSense, Hesai, Velodyne, and Ouster are among the top 15 newcomers.

China has built a formidable LiDAR industry. Yole Intelligence, a division of Yole Group, has identified 15 Chinese LiDAR firms.

Furthermore, Chinese LiDAR firms are not tiny. Hesai and RoboSense are currently the world's top two 3D real-time LiDAR firms.

Yole Intelligence now provides a comprehensive study on the automotive and industrial industry areas.: LiDAR 2022 – Focus on Automotive and Industrial report. The purpose of this research is to give information on the growth of technology, market trends, and the competitive landscape. It offers a detailed examination of the Chinese ecology.

“The Chinese LiDAR push is not limited to LiDAR companies. China has developed a significant, if not yet complete, LiDAR ecosystem. Among the various LiDAR companies, several provide components, design, and software.”, Pierrick Boulay, Senior Technology & Market Analyst at Yole Intelligence

Hitronics, for example, employs 1,700 people and creates and produces optical components, optical systems, receivers, and lasers. The business will deliver auto-grade 1,550nm fiber lasers for LiDAR in 2022, with a production capacity of 250k units per year.

Liangdao is another example of the Chinese LiDAR ecosystem. The business creates LiDAR perception software and has built LiDAR perception assessment systems. It is presently working on developing short-range flash LiDAR. A team of 200 software developers may be required to build LiDAR perception software. For this software, OEMs are migrating from internal to external development.

The Chinese ecosystem includes LiDAR users as well as components, design, and software. The Chinese auto industry is developing new electric passenger vehicles with advanced autonomous driving technologies, such as LiDAR. Logistics, smart infrastructure, robotaxis, and delivery robots are also being developed vigorously in China, resulting in a large and broad demand for LiDAR. At the same time, Chinese enterprises are expanding their growth in topographic applications.

Finally, there is a significant difference between Chinese and international LiDAR businesses that may be essential in the shift to mass-volume manufacturing. Although overseas LiDAR businesses depend on external manufacturing, RoboSense and Hesai have built manufacturing capabilities that will give them more control over high-volume production.

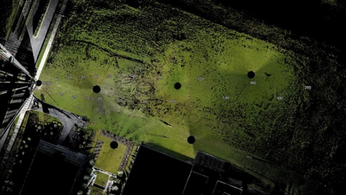

“LiDAR growth will not be limited to automotive applications. Various projects for smart infrastructure are ongoing, including intersection monitoring and security.

Furthermore, the automation of the logistics chain is also pulling the LiDAR market. The logistics LiDAR market will reach $344 million in 2027, from $92million in 2021.”, Alexis Debray, PhD., Technology & Market Analyst at Yole Intelligence

More information about the market study in the Yole website:

LiDAR INSIGHTER Newsletter

Join the newsletter to receive the latest updates in your inbox.